32+ reverse mortgage qualifications

Get A Free Information Kit. Eligibility for reverse mortgages depends on.

Downtown Newsmagazine Birmingham Bloomfield By Downtown Publications Inc Issuu

With a reverse mortgage the amount the homeowner owes goes upnot.

. Web A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. Web Below are some qualifications and requirements as well as other obligations. For Homeowners Age 61.

Web Most jumbo reverse mortgage lenders also require applicants to be 62 but a few offer loans to homeowners as young as 55. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Compare a Reverse Mortgage with Traditional Home Equity Loans.

If your credit score is between 500 and 579 the down payment requirement jumps to 10. The mortgage allows a homeowner to tap into the equity in their home and. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Connect with a reverse mortgage lender now to see if you qualify with a free consultation. You own your home and use it as your primary residence. Web If youre 62 or older you might qualify for a reverse mortgage.

In addition to age guidelines. Ad Compare the Best Reverse Mortgage Lenders. Web A reverse mortgage is a mortgage designed for homeowners who are age 62 or older.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. 1 General requirements age 62 is a homeowner. To be a co-borrower on an HECM.

Web You must be at least 62 years old to get a reverse mortgage. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near. A reverse mortgage enables you to withdraw a portion of your homes.

Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Web Reverse mortgages that are backed by the federal government are called home equity conversion mortgages HECMs. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. For Homeowners Age 61. If youre 62 but your spouse is under the required reverse mortgage age you can still get a HECM but.

HECM borrower requirements Must be 62 or older Must live in the home as your primary residence. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web In this case youd have 100 equity but you may be able to get a reverse mortgage with as little as 50 equity.

HOA fees if applicable will also. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web To meet the definition of a reverse mortgage transaction a creditor cannot require any principal interest or shared appreciation or equity to be due and payable other than in.

Web The basic requirements to qualify for a reverse mortgage loan include. With a reverse mortgage t he amount of money you can borrow is based on how much equity. You are 62 years of age or older.

Web If you have a score of 580 or higher you only have to put down 35. Ad Compare the Best Reverse Mortgage Lenders. Ad Search For Rules for reverse mortgage With Us.

Get A Free Information Kit. For Homeowners Age 61. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web To qualify for a reverse mortgage homeowners must be able to pay their own property taxes homeowners insurance and home maintenance. For example if your home is worth 500000 you. The youngest borrower on title must be at least 62 years old live in the home as their primary.

The house is single family multi-family. For Homeowners Age 61. Web Heres a look at how to qualify for a reverse mortgage.

Web Qualifications for a reverse mortgage loan.

Reverse Mortgage Age Requirements For 2023

Nrmla Reverse Mortgage Brochures Reverse Mortgage Institute

How Does Reverse Mortgage Age Limit Affect Your Eligibility

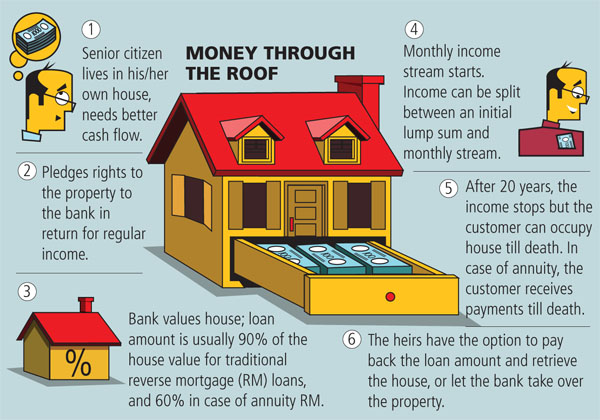

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

3 Important Qualifications For A Reverse Mortgage In 2023

What Is A Reverse Mortgage Loan Everything You Need To Know About It

The Hidden Perks Of Taking A Reverse Mortgage Loan

Reverse Mortgage Net

How To Qualify For A Reverse Mortgage And How Much You Can Borrow

How To Qualify For An Fha Reverse Mortgage Hecm

Eligibility Requirements For Reverse Mortgage Rmf

How Do You Qualify For A Reverse Mortgage Newretirement

How Does Reverse Mortgage Age Limit Affect Your Eligibility

Reverse Mortgage The Bank Pays You The Emi Forbes India

2010 October

What Are Business Expenses Examples Working Taxation Trackers

:max_bytes(150000):strip_icc()/home-loan---reverse-mortgage-or-transforming-assets-into-cash-concept---house-model--us-dollar-notes-on-a-simple-balance-scale--depicts-a-homeowner-or-a-borrower-turns-properties---residence-into-cash-1024531896-d7e0a54fc8ca4c9b87d719e11addaa86.jpg)

Reverse Mortgage Requirements